June 2022

The 1980s, 1990s and early noughties was a period of growth with some volatility — notably the Black Monday crash of 1987, Black Wednesday in 1992 when George Soros won his bet against the Bank of England, leading to losses of more than £3bn, and of course the tech bubble. High interest rates were the norm and inflation exceeded 10 per cent in the early 1990s.

Actuarial valuations in the 1980s and 1990s were very different to what we see now. The actuary’s financial assumptions were typically based on a long-term view of expected investment returns, salary increases and inflation — it was common to see 9 per cent investment returns, 7 per cent salary increases, and 5 per cent price inflation.

On the asset side, rather than taking the market value, asset values were adjusted to allow for differences between the actuary’s long-term financial assumptions and market conditions at the valuation date — something the accountants later addressed with the introduction of the FRS17 accounting standard for company accounting valuations, which very quickly led to the widespread use of market values in funding valuations.

On the demographic side, with the benefit of hindsight, life expectancies were understated. As you might expect, the regulations surrounding valuations were very different in the 1980s and 1990s.

With the statutory surplus test applying to all schemes, the focus was more about not having a surplus than not having a deficit. As a result, many employers were required to improve members’ benefits or take a contribution holiday.

The key event that changed everything was Robert Maxwell looting the Mirror pension fund for hundreds of millions of pounds, leading to a 50 per cent cut in members’ benefits.

The blame lay firmly with Maxwell and his advisers. The lessons were the need for better governance and the need to protect members.

The result was the Pensions Act 1995, which came into force in April 97. Among other things, the act introduced the legal requirement for scheme actuaries and scheme auditors, with increased and statutory responsibilities, inflation linking of pensions, and a minimum funding requirement.

We also saw the introduction of the Occupational Pensions Regulatory Authority, the forerunner of the Pensions Regulator.

The introduction of the Pensions Act 1995 changed the focus to providing a minimum level of protection for members, improved benefits and improved governance.

Again, with the benefit of hindsight, the one-size-fits-all protection of the minimum funding requirement was not strong enough and the improvements, while undoubtedly good for members while they lasted, perhaps contributed to the accelerated closure of schemes to accrual.

Due to the low level of protection for non-pensioners, the inflexible nature of the minimum funding requirement, and OPRA’s lack of any real power, the regime was changed in 2005 when the Pensions Act 2004 came into effect.

Before looking into the future, it is worth reminding ourselves of what we have now and thinking about what the key issues really are.

The current regime was introduced in the Pensions Act 2004 and applied to all valuations with an effective date on or after September 22 2005. It had three key elements:

On reflection, PA2004 provided a balanced regulatory framework that has served us well for the past 17 years. As well as improving overall funding (as shown later), the main benefits were:

Some long-serving trustees have worked through six valuations under the current funding regulations, enduring significant challenges along the way including the global financial crisis of 2007-08, the eurozone crisis of 2011, Brexit, Covid 19, and now the fallout from Russia’s invasion of Ukraine and the ongoing war.

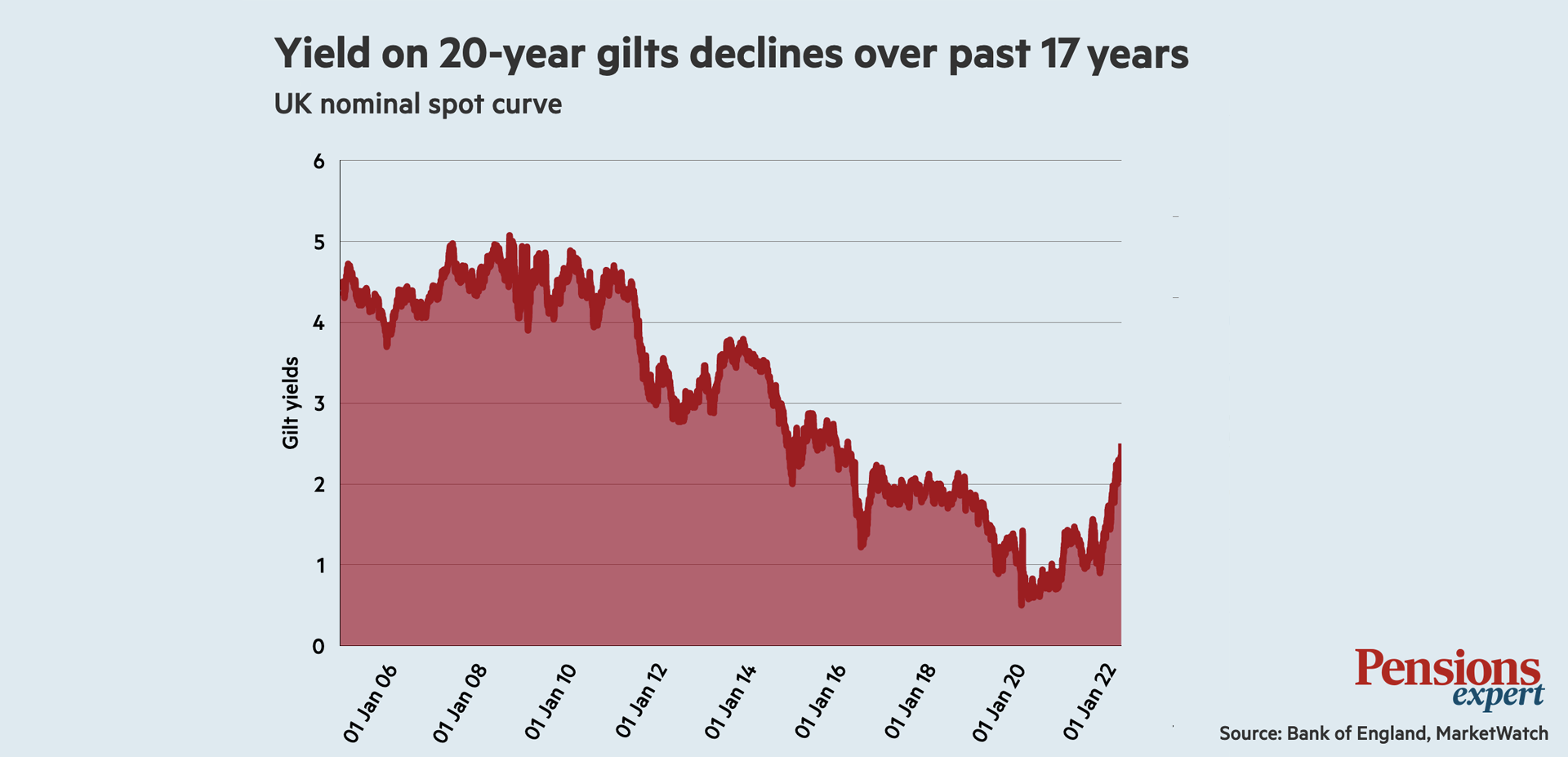

Most of this 17-year period has been characterised by falling interest rates — the chart below shows the yield on 20-year gilts, which is often used by actuaries as a baseline for the discount rates used to value liabilities.

Although this fall in yields led to a steady and significant rise in liabilities, it coincided with a period of strong — if sometimes volatile — returns on most asset classes, especially equities.

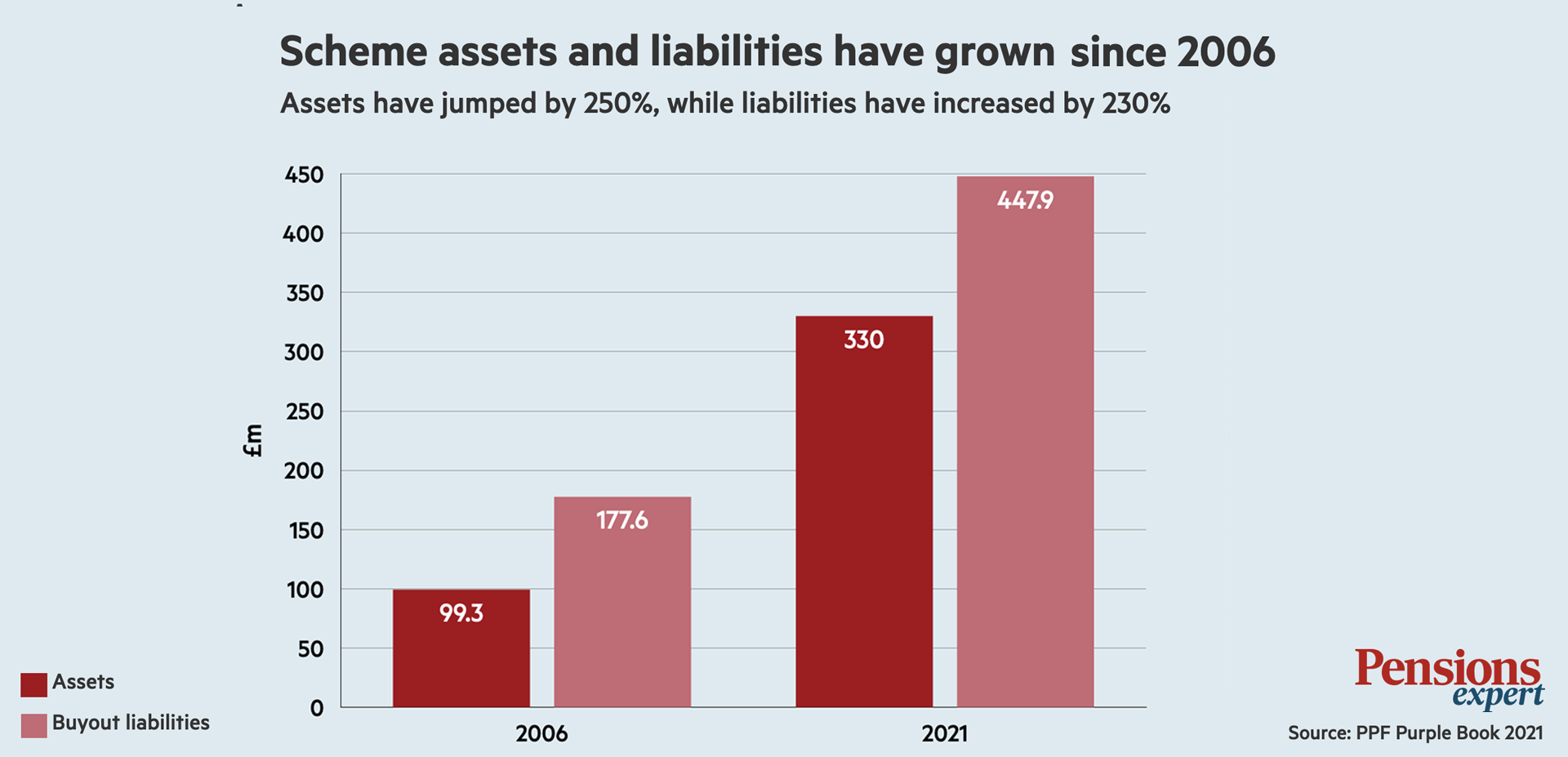

Crucially, for scheme funding and the security of members’ benefits, assets have grown more than liabilities, leading to a significant improvement in the funding position of the average DB scheme.

Using the more objective measure of buyout, the funding level of the average DB scheme has increased from 56 per cent to 74 per cent between 2006 and 2021. At the same time, the overall number of DB schemes has reduced by one-third due to wind-up, scheme mergers or employer insolvency.

The chart below shows the extent to which the assets and (buyout) liabilities of the average DB scheme have grown between 2006 and 2021.

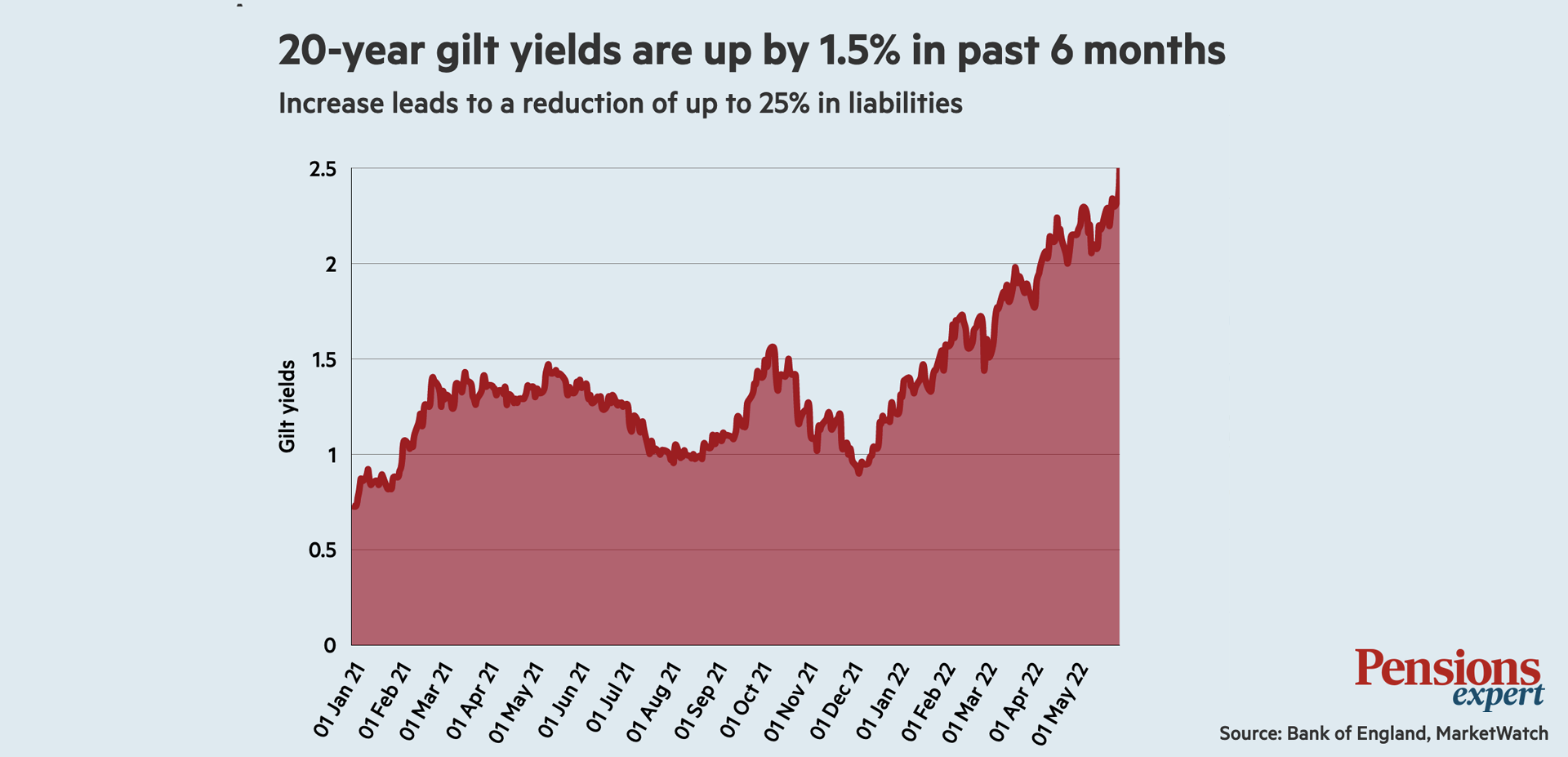

Although 2022 data is not available, we expect to see a further improvement in buyout funding for most schemes, due to the sharp rise in long-term interest rates since the start of 2022, as shown in the chart below, which plots the 20-year fixed interest gilt yield.

As a result, we expect to see an acceleration in the number of schemes undertaking insurance transactions and moving towards wind-up during 2022.

Looking back, some employers will argue that they were forced to pay higher contributions than necessary, impacting on their businesses.

Some employers and trustees will also argue that schemes were effectively forced into using gilt-based discount rates, leading to a significantly increased cost of accrual, as gilt yields fell and accelerating the closure of DB schemes to accrual.

This view is supported by TPR’s statistics, which show that the proportion of schemes closed to accrual increased from 15 per cent in 2006 to 50 per cent in 2021, contributing to the intergenerational pensions inequity that has emerged over the past 20 years.

In short, while PA2004 has undoubtedly been good for the security of accrued benefits and pension scheme governance, it has also contributed to a fall in the quality of future pension provision.

Before looking into the future, we should acknowledge wider TPR guidance under the current regime and the overall impact on scheme behaviour.

Investment — the focus has been on reducing risk, with schemes moving from “return-seeking” portfolios to “matching” portfolios. The average allocation to equities has reduced from 61 per cent in 2006 to 19 per cent in 2021. At the same time, there has been a steady increase in the allocation to bonds, including leveraged liability-driven investment funds. Some of this is due to schemes maturing, but the main factor has been an increased focus on reducing risk and matching liabilities.

Risk management — TPR has encouraged trustees to take a holistic view to managing pension risk. This has led to some innovative thinking on what the risks are and how they should be managed. As with funding, the approach has been prudent and the focus has been on reducing and removing risk. Examples include floating bank guarantees to manage covenant risk, and derisking triggers to lock in investment gains and reduce risk going forwards.

Long-term thinking — over recent years TPR has encouraged all trustees and employers to set a joined-up, long-term target and put in place a plan to get there.

As schemes mature and funding improves (ie, as schemes get closer to their ultimate target), the approach to valuations has become more accurate for some trustees, including:

The aim here is to increase the alignment of the funding assumptions with insurer pricing to help ensure a smooth transition to buyout.

The current funding regime has seen a period of significant growth in both assets and liabilities. For the majority of DB schemes that are closed to new entrants and/or accrual, we now expect to see a period of run-off, with assets and liabilities reducing as benefit outgo increases over the next 10 years and beyond.

We also expect to see a continued increase in risk transfer activity, supported by changes to Solvency II requirements, which may mean new entrants to the bulk annuity market and better pricing.

The exception is schemes that are open to new entrants and accrual. These schemes should rightly have a different focus. They can take a much longer-term view on investment and funding and, provided the employer is strong enough (which it should be if the scheme is still open), do not need to think about insurance. The key issues for open schemes are:

The new funding regulations have been delayed and are not expected to be in place until 2023 at the earliest.

It remains to be seen whether we will see a modified version of the “fast-track” and “bespoke” approach originally proposed by TPR. However, I think we can be confident that the following will be front and centre of the new regime:

In short, keep doing the right things for your scheme and your members. That means:

Looking forward, to a large extent, it does not matter what the new regulations look like — and the truth is, none of us know. The most important thing is to stay focused on the fundamentals and keep moving in the right direction.

Jonathan Seed is scheme actuary and head of pensions strategy at Cartwright

To discuss your specific requirements with a member of our team, please start by sending us a brief message or, if your enquiry is more urgent, call our Head Office on 01252 894 883 and we will be put you in contact with the right person.