November 2021

Any trustee’s ultimate responsibility is to ensure that benefits are paid in full up to and including the final payment to the very last member. The challenge is how to deliver on something that is so far away. The only way to meet this challenge is to design and implement a cohesive strategy for your scheme.

The right strategy will depend on your specific circumstances - covenant strength, maturity, risk appetite and - crucially - the size of the buyout gap.

In all cases, the strategy should include three key elements:

Start at the end

The ultimate destination for the majority of schemes will be buyout and wind up. Exceptions include the few remaining open DB schemes and some schemes who may not be able to reach this target.

For schemes where the gap to buyout is large, it is important to understand how the different funding targets are expected to develop and identify milestones on the way to your ultimate destination. Each milestone will represent an improvement in the security of members’ benefits.

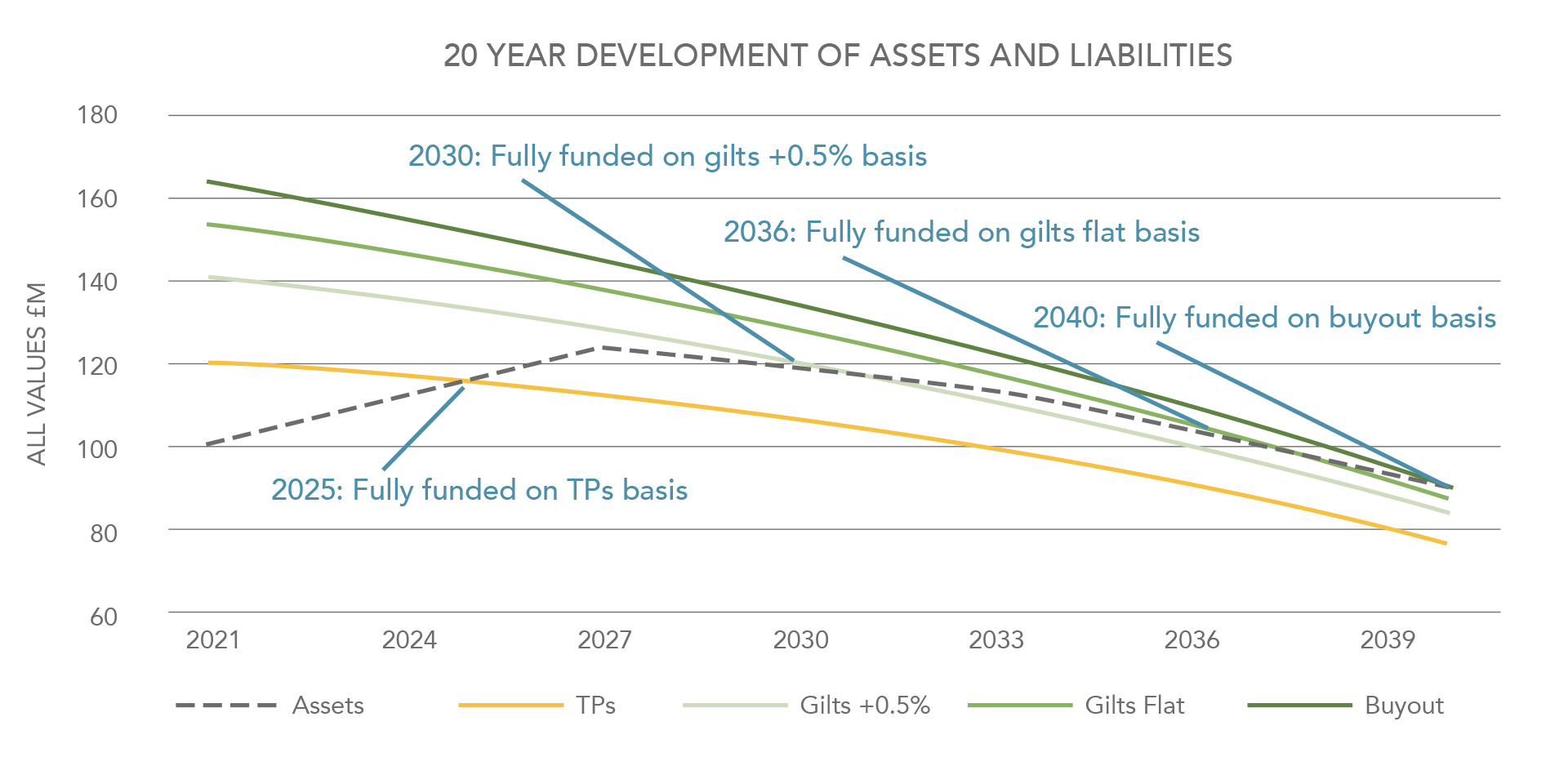

The example below shows how scheme assets are expected to progress relative to different liability measures over the next 20 years. We can see the assets grow quickly as contributions are paid in and then move steadily through the stronger funding targets based on modest asset performance alone.

Is your strategy FIT for purpose?

Another critical element of your strategy is to ensure that your destination includes both a clearly defined funding target and a corresponding low risk investment strategy. To put it another way, a funding and investment target ("FIT”)

In the same way as the funding position strengthens over time, investment risk should reduce as your scheme matures. This could be done in a number of ways, including:-

Whatever method is used, it is essential to allow for the impact of de-risking on future asset returns.

Know your Limits

The limiting factor for any strategy is risk. Overall risk should be within the employer’s risk capacity both at outset and over the period until low dependency is reached. Here, it is essential that all risks are captured and that that different potential strategies are compared on a like-for-like basis.

Bridging the gap

Once you understand the scale of the challenge and your risk capacity you can start looking at different strategies to bridge the gap.

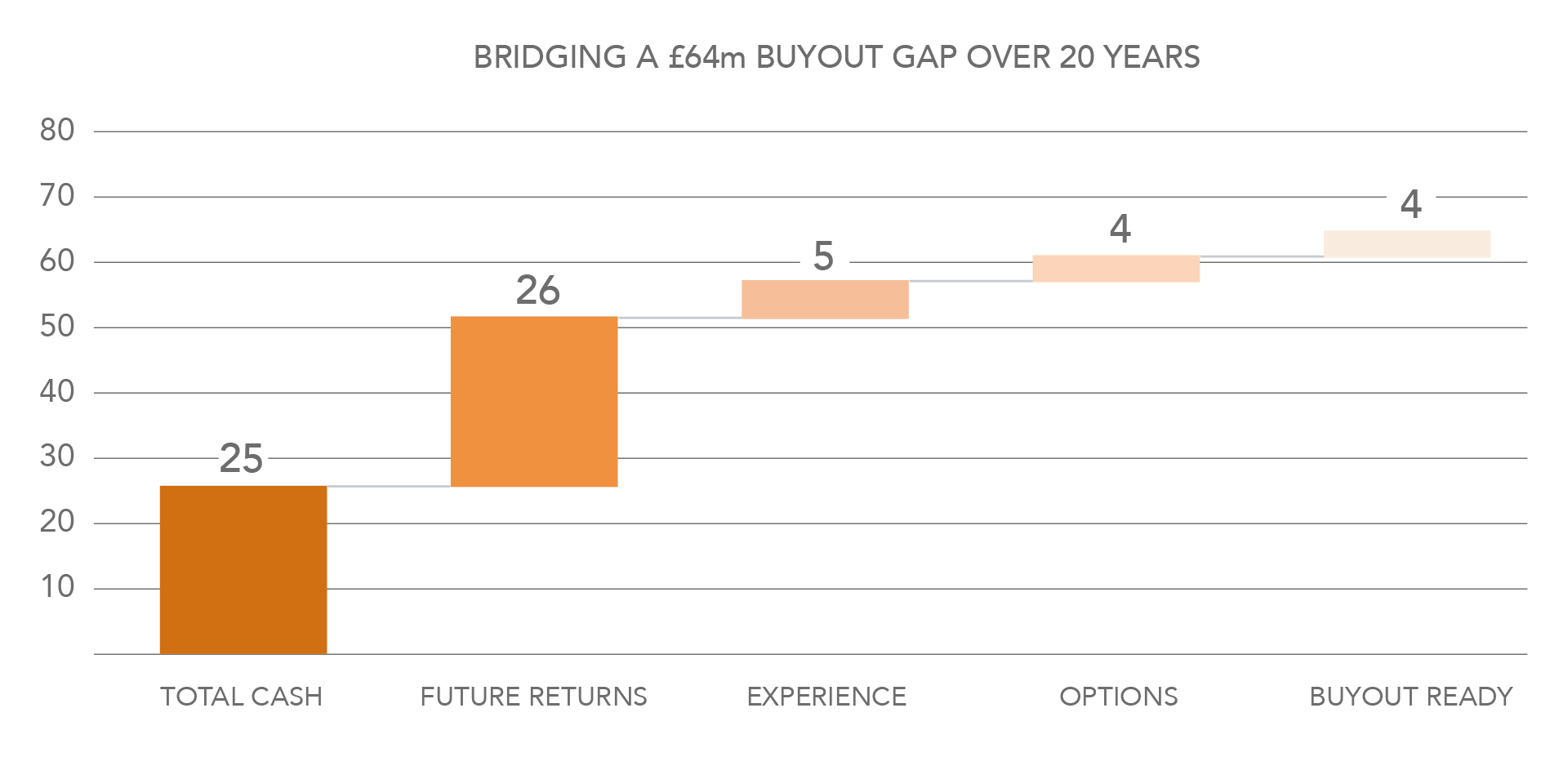

Based on the same scheme used in the earlier example, the following graph shows how a £64m buyout deficit can be closed using a 20 year plan involving gradual de-risking supported by member options and scheme experience including transfers.

It is essential to understand the reliance on each component and the overall risk involved. In general, greater reliance on time and asset returns means more risk. However, unless your scheme has already achieved buyout, your strategy will involve some level of risk. The key is that all risktaking should be fully informed, aligned with your objectives and managed within limits to keep you on target.

Taking the first step

Don’t worry if the ultimate destination of buyout seems too far off - you can start by targeting low dependency. The key thing is to get a strategy in place and then to keep moving in the right direction towards your ultimate destination.

To discuss your specific requirements with a member of our team, please start by sending us a brief message or, if your enquiry is more urgent, call our Head Office on 01252 894 883 and we will be put you in contact with the right person.